The CEO of University of Bristol spin-out Fathom has praised law firm Ashfords on its role in its sale to one of the world’s largest reinsurance businesses.

Fathom, a leader in global flood risk intelligence, was snapped up by Swiss Re in December.

Since its launch in 2013, Fathom has worked with businesses and government agencies and across industries, including humanitarian aid, insurance, international development, engineering, conservation and financial markets, to provide market-leading flood models.

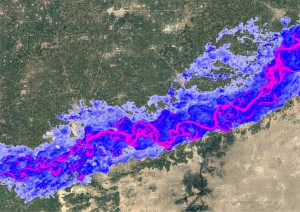

The firm, which emerged from research carried out by the University of Bristol Hydrology Group, has pioneered enhanced modelling approaches that are scientifically validated and effectively applied to solve industry challenges, pictured.

These give risk management professionals the most scientifically robust tools and intelligence for understanding the climate’s impact on water risk.

The firm is now working closely with Zurich-headquartered Swiss Re’s Reinsurance Solutions division to provide innovative tools that help improve society’s resilience against floods.

Fathom CEO Stuart Whitfield said Ashfords, which advised Fathom on all aspects of the transaction, had been “a trusted and responsive partner throughout the delivery of [the] deal with Swiss Re”.

He added “A huge thank you to the team for overseeing the particulars of the acquisition, from the retention of our brand to the continuation of our well-established research activities.

“By aligning with Swiss Re Reinsurance Solutions, we’re excited to bring our insights to more customers and help deliver greater global flood and climate resilience.”

Head of Ashfords technology sector team Chris Dyson, pictured, who is based in its Bristol office, said Fathom was a great example of how research, data and technology could be used to tackle key environmental issues.

“We supported Fathom with their fundraising and are proud to have supported management on the company’s growth, leading to this landmark sale to Swiss Re, which will enable the business to accelerate the development and distribution of solutions to improve risk resilience,” he added.

Financial details of the sale have not been disclosed.

Ashfords, which employs more than 500 people, also has offices in London, Exeter and Plymouth.

The firm has extensive experience working with innovative technology clients and high-growth businesses.

Its technology sector team provides clients with expertise across all key areas including investments, acquisitions, regulation, data, tax, immigration and employment, commercial contracts and protecting IP.